Home Insurance, both buildings and contents, are not a legal requirement. It is your choice whether or not you want to buy it.

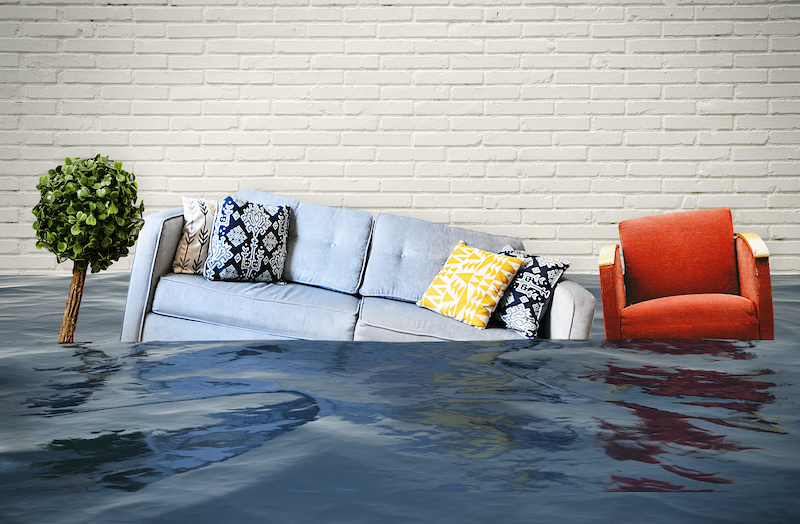

However, the recent flash floods experienced in some parts of the UK are a stark reminder as to why investing in contents insurance is actually money well spent.

Flash Floods Hit the UK

Homes in Norton Fitzwarren in Somerset and homes in South-West, North and North-West London have been hit particularly hard recently. And when your home is flooded not only can it be incredibly inconvenient but it can have a huge emotional impact too. You may have to salvage much loved and valuable, irreplaceable possessions. You also may have to move into temporary accommodation while your home is repaired.

The Importance of Home Insurance

This is where having home insurance in place can be huge relief. It can give you and your family the peace of mind that should the worst happen you will have some degree of protection in place. Depending on the level of cover you choose you could be covered for rebuilding or repairing your home following a fire or flood, to replacing your possessions if they are damaged or lost.

Do I Need Contents Insurance?

If you rent your home you should still consider buying insurance to cover your contents. Your landlord should have buildings insurance in place but their policy is very unlikely to cover your contents. According to Money Saving Expert, half of all renters do not purchase contents insurance. If something is damaged or stolen from your home then you would have to cover the cost of replacing it yourself. If you have tenants contents insurance in place you would be able to make a claim.

What Contents Insurance Covers

Depending on the contents insurance cover you buy, it can:

- cover you for accidental damage to electronic equipment like laptops, TVs and tablets

- cover damage or loss of personal items such as jewellery, cameras, bicycles and musical instruments

- provide alternative accommodation if you are unable to stay in your home following an incident

Every insurance company will have slightly different policies and you may have to itemise some higher value items like jewellery, bikes and laptops. It is worth delving into the detail and make sure you read the policy wordings carefully before you buy.

Insure your Contents

If you are a tenant or renter looking to buy a contents policy, our client Hazelton Mountford can give you a quick online quote.